A Place for Mom

Health & Learning

We deploy a set of complementary strategies to support accelerated growth and digital transformation across an expanding range of opportunities aligned with our core competencies–structuring each investment flexibly, undertaking operational initiatives on an as-invited basis and not relying on a playbook

Silver Lake Partners

Large-Scale Technology Investing Flagship

Silver Lake Alpine

Generally Downside-Protected with Equity Upside

Silver Lake Long Term Capital

25-Year Long Term Strategy

Health & Learning

Enterprise Software

Travel Technology

Enterprise Software

Software Application Development

Internet & eCommerce

Internet & eCommerce

Semiconductors

Content & Entertainment

Internet & eCommerce

Financial Technology

Enterprise Software

Content & Entertainment

Semiconductors

Enterprise Communications

Enterprise Communications

Financial Technology

Enterprise Software

Compute & Communications

Semiconductors

Health & Learning

Advanced Manufacturing

Health & Learning

Enterprise Software

Content & Entertainment

Technology Marketing & Distribution

Enterprise Software

Enterprise Software

Content & Entertainment

Enterprise Software

Advanced Manufacturing

Tech-enabled Retail

Health & Learning

Financial Technology

Enterprise Software

Travel Technology

Financial Technology

Compute & Communications

Content & Entertainment

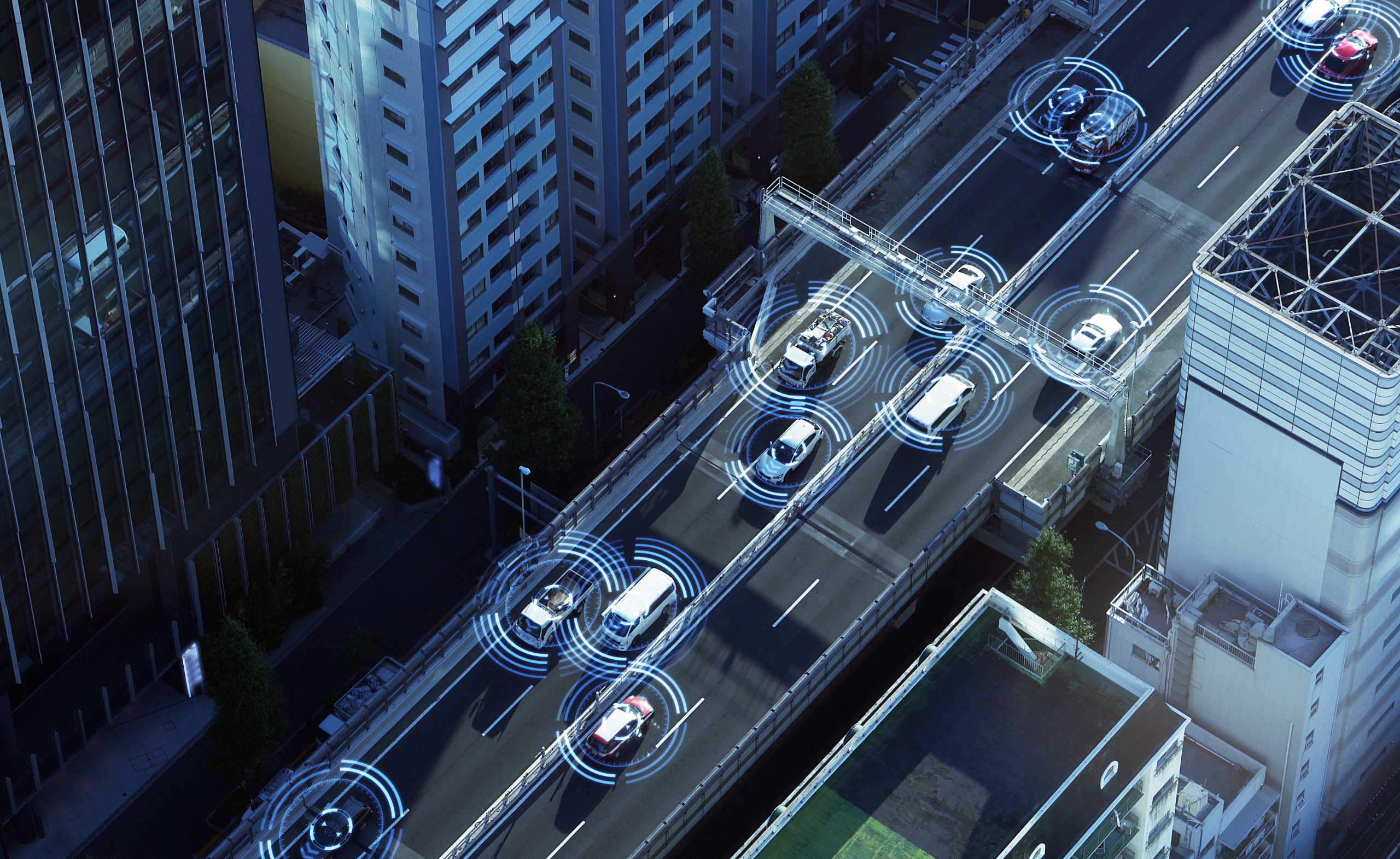

Mobility

Enterprise Software

Enterprise Software

Content & Entertainment

Data Centers & Networking

Real Estate Technology

Health & Learning

Enterprise Software

Enterprise Software

Travel Technology

Financial Technology

Content & Entertainment

Internet & eCommerce

Enterprise Software

Security

Advanced Manufacturing

Mobility

Mobility

Compute & Communications

Information & Data Services

Content & Entertainment

Expert Consultant Network

Internet & eCommerce

Financial Technology

Financial Technology

Semiconductors

Internet & eCommerce

Health & Learning

Financial Technology

Internet & eCommerce

Processing

Data Centers & Networking

Mobile Device Services

Data & Analytics

Health & Learning

Financial Technology

Health & Learning

Enterprise Communications

Financial Market Data

Compute & Communications

Compute & Communications

Electronic Securities Trading

Enterprise Software

Health & Learning

Compute & Communications

Data Centers & Networking

Financial Technology

Internet & eCommerce

Content & Entertainment

Real Estate Technology

Internet & eCommerce

Content & Entertainment

Telecommunications

Health & Learning

Financial Technology

Enterprise Software

Health & Learning

Compute & Communications

Health & Learning

IT Management Software & Services

Financial Technology

IT Management Software & Services

Content & Entertainment

Real Estate Technology

Health & Learning

Security Systems & Technology

Semiconductors

Content & Entertainment

Travel Technology

Data & Analytics

Enterprise Software

Enterprise Software

Financial Technology

Advanced Manufacturing

Content & Entertainment

HR Services & Technology

Enterprise Software

Enterprise Software

Mobility

Internet & eCommerce

Enterprise Software

Internet & eCommerce

Real Estate Technology

Data Centers & Networking

Financial Technology

Travel Technology

Data Storage & Management

Semiconductors

Enterprise Software

Enterprise Software

Enterprise Software

Content & Entertainment

Enterprise Software

Compute & Communications

Semiconductors

Semiconductors

Financial Technology

Enterprise Software

Real Estate Technology

IT Management Software & Services

Semiconductors

Enterprise Software

Semiconductors

Financial Technology

Internet & eCommerce

Enterprise Software

Health & Learning

Data & Analytics

Enterprise Communications

Enterprise Software

Content & Entertainment

Data Centers & Networking

Mobility

Content & Entertainment

Internet & eCommerce

Content & Entertainment

Compute & Communications

Content & Entertainment

Content & Entertainment

Enterprise Software

Enterprise Software

Content & Entertainment

Cable Operations

Travel Technology

Data Centers & Networking

Data Centers & Networking

Health & Learning

Financial Technology

Infrastructure Software

Mobility

Internet & eCommerce

Compute & Communications

Enterprise Software

Real Estate Technology

Enterprise Software

Content & Entertainment

Please inquire at [email protected] if you would like additional information about specific investments in the Long Term Capital portfolio.

The portfolio companies shown represent a substantial portion of Silver Lake’s current and past portfolio companies in active Silver Lake strategies (i.e., those that are currently in their investment period). Certain portfolio companies among the active strategies have been excluded for a variety of reasons such as, but not by limitation, due to their confidential nature, size or nature of ownership interest, or otherwise for non-performance based reasons subject to Silver Lake’s discretion. The portfolio companies identified here, because they comprise only a subset of all portfolio companies, are not representative of all of the investments made by each Silver Lake Fund. It should not be assumed that Silver Lake’s investments in the portfolio companies included herein have been or will be profitable. Some portfolio companies have been invested in by multiple Silver Lake Funds, and the actual holdings may vary for each Fund. For a list including past Silver Lake investments, please navigate to the drop down menus on this page. While SLA generally targets and structures investments which are downside protected to limit risk of capital loss with potential for equity upside, there can be no assurances that the downside protection of SLA investments will mitigate losses or reduce losses compared to traditional private equity investments or credit funds or that SLA’s overarching investment objectives will be achieved.

You are currently viewing a placeholder content from Facebook. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from Instagram. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from X. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information